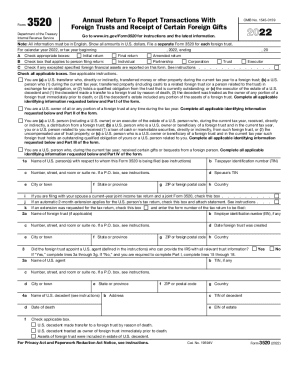

IRS 3520 2023-2025 free printable template

Show details

If these documents have been attached to a Form 3520-A or Form 3520 filed within the previous 3 years attach only relevant updates. If No to the best of your ability complete and attach a substitute Form 3520-A for the foreign trust. See instructions for information on penalties for failing to complete and attach a substitute Form 3520-A. If these documents have been attached to a Form 3520 filed within the previous 3 years attach only relevant updates. If a P. O. box see instructions. d...

pdfFiller is not affiliated with IRS

Understanding and Navigating the IRS Form 3520

Guidelines for Modifying IRS Form 3520

How to Fill Out IRS Form 3520 Effectively

Understanding and Navigating the IRS Form 3520

The IRS Form 3520 is an essential document for taxpayers with certain foreign financial interests. Its primary purpose is to report transactions with foreign trusts, the receipt of certain foreign gifts, and the establishment of foreign accounts. Understanding this form is crucial for compliance and can help avoid significant penalties. In this guide, we will delve into the specifics of IRS Form 3520, including who needs to complete it, exemptions, filing requirements, and penalties for non-compliance.

Guidelines for Modifying IRS Form 3520

Editing IRS Form 3520 should be done with precision to ensure accurate reporting. Follow these steps:

01

Review the current form for accuracy, ensuring all details reflect your financial transactions accurately.

02

Consult the guidelines provided by the IRS specific to Form 3520.

03

Make necessary corrections clearly, avoiding overstriking or ambiguous marks that could lead to misinterpretation.

04

Double-check the form for completion, ensuring all required sections are filled out.

05

Save a copy of your completed form for your records.

How to Fill Out IRS Form 3520 Effectively

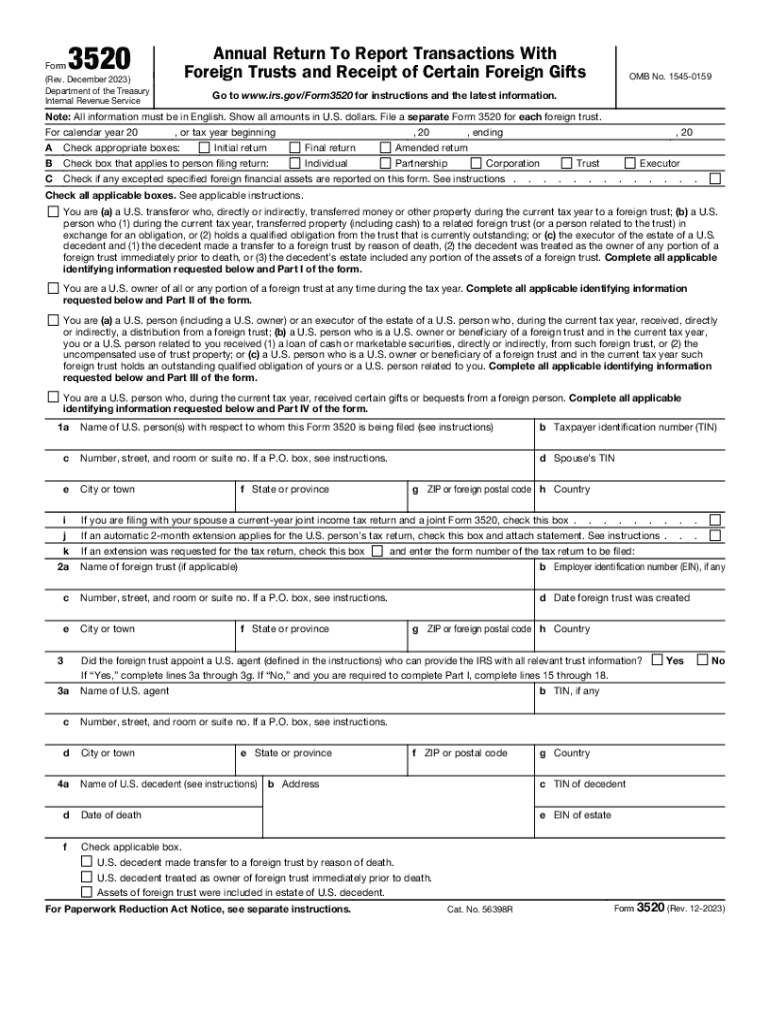

Completing IRS Form 3520 involves several key steps:

01

Gather necessary documentation, including details about foreign gifts, foreign trust transactions, and supporting financial records.

02

Provide your identification information, including your Social Security Number (SSN) or Employer Identification Number (EIN).

03

Indicate your relationship to the foreign trust or the source of the foreign gift.

04

Report any relevant transactions precisely, such as the amounts received and the nature of the transactions.

05

Sign and date the form before submission to authenticate the information provided.

Show more

Show less

Recent Modifications and Important Updates to IRS Form 3520

Recent Modifications and Important Updates to IRS Form 3520

Staying informed about recent changes to IRS Form 3520 is critical for compliance. Recent updates include adjustments to reporting thresholds and revised instructions to clarify the form’s requirements. For instance, as of 2023, the minimum reporting threshold for foreign gifts has been updated to $100,000 for individuals, prompting increased vigilance for taxpayers receiving international transfers.

Essential Insights into IRS Form 3520

An Overview of IRS Form 3520

Purpose Behind IRS Form 3520

Who is Required to File IRS Form 3520?

Conditions for Exemption from IRS Form 3520 Submission

File Submission Deadlines for IRS Form 3520

Comparing IRS Form 3520 with Similar IRS Forms

Types of Transactions Covered Under IRS Form 3520

Submissions Specifications: Required Copies of IRS Form 3520

Consequences for Failing to Submit IRS Form 3520

Information Needed for Filing IRS Form 3520

Other Forms Often Filed with IRS Form 3520

Where to Submit IRS Form 3520

Essential Insights into IRS Form 3520

An Overview of IRS Form 3520

Form 3520 is a specialized document used by U.S. taxpayers to report certain transactions involving foreign trusts and gifts. This form is not part of your standard tax return but is crucial for maintaining compliance with U.S. tax laws regarding foreign financial interests.

Purpose Behind IRS Form 3520

Form 3520 serves several crucial functions:

01

To inform the IRS of transfers to foreign trusts.

02

To report large foreign gifts received.

03

To disclose interests in foreign trusts maintained by U.S. taxpayers.

Who is Required to File IRS Form 3520?

Taxpayers must complete Form 3520 if they have engaged in any of the following:

01

Received gifts or bequests from foreign individuals exceeding specified amounts.

02

Transferred money or property to a foreign trust.

03

Received distributions from a foreign trust.

For example, if you receive a foreign gift valued at $150,000, you need to report that using Form 3520, even if it's from a family member.

Conditions for Exemption from IRS Form 3520 Submission

Exemptions from filing IRS Form 3520 may apply under specific circumstances:

01

If you do not exceed the reporting threshold on foreign gifts (currently $100,000 from foreign individuals).

02

If the trust is a foreign trust for tax purposes and you report and pay tax on its income.

03

Transactions below a certain threshold, such as minor gifts or contributions, may also qualify.

File Submission Deadlines for IRS Form 3520

The deadline to file IRS Form 3520 aligns with the tax return deadline, which is typically April 15. However, if you file for an extension, the deadline will be extended to October 15. It's essential to ensure timely submission to avoid potential penalties.

Comparing IRS Form 3520 with Similar IRS Forms

Form 3520 is often compared with IRS Form 8938 (Statement of Specified Foreign Financial Assets) and Form 114 (FBAR). While Form 8938 requires reporting of foreign financial assets exceeding $50,000, Form 3520 focuses on foreign trusts and gifts, distinguishing its specific compliance requirements.

Types of Transactions Covered Under IRS Form 3520

IRS Form 3520 addresses various transactions, including:

01

Gifts from foreign persons exceeding $100,000.

02

Transfer of assets to foreign trusts.

03

Receiving distributions from foreign trusts.

Submissions Specifications: Required Copies of IRS Form 3520

Only one copy of IRS Form 3520 is required for submission to the IRS, but taxpayers are advised to retain a copy for their personal records and any future audits.

Consequences for Failing to Submit IRS Form 3520

Failure to file or late submission of IRS Form 3520 can lead to severe penalties, including:

01

Initial penalties of $10,000 for failing to file.

02

Additional penalties up to 35% of the amount reported late if gifts or transfers are substantial.

03

Legal consequences depending on the severity of non-compliance, potentially including more stringent auditing.

Information Needed for Filing IRS Form 3520

To successfully file Form 3520, prepare the following information:

01

Your identification details (SSN or EIN).

02

Details regarding foreign trusts if applicable, including the names and EINs.

03

Information about foreign gifts, including the value and donor details.

Other Forms Often Filed with IRS Form 3520

While Form 3520 is distinct, it may accompany other forms depending on specific situations:

01

Form 8938 for reporting foreign financial assets.

02

FBAR (FinCEN Form 114) if there are foreign bank accounts involved.

Where to Submit IRS Form 3520

IRS Form 3520 should be mailed to the address specified in the form instructions, typically the address designated for the center that handles forms for your state. Confirm the address prior to submission to ensure your form reaches the appropriate IRS office without delay.

By understanding IRS Form 3520, you can ensure compliance and avoid unnecessary penalties. For further assistance, consider utilizing resources such as tax professionals or consult tools that simplify the filing process. Start taking action today to manage your tax responsibilities effectively.

Show more

Show less

Try Risk Free