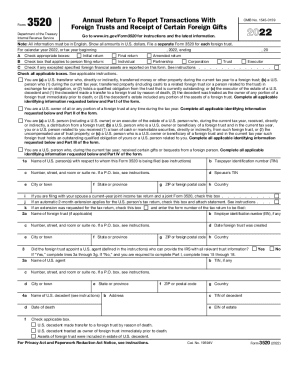

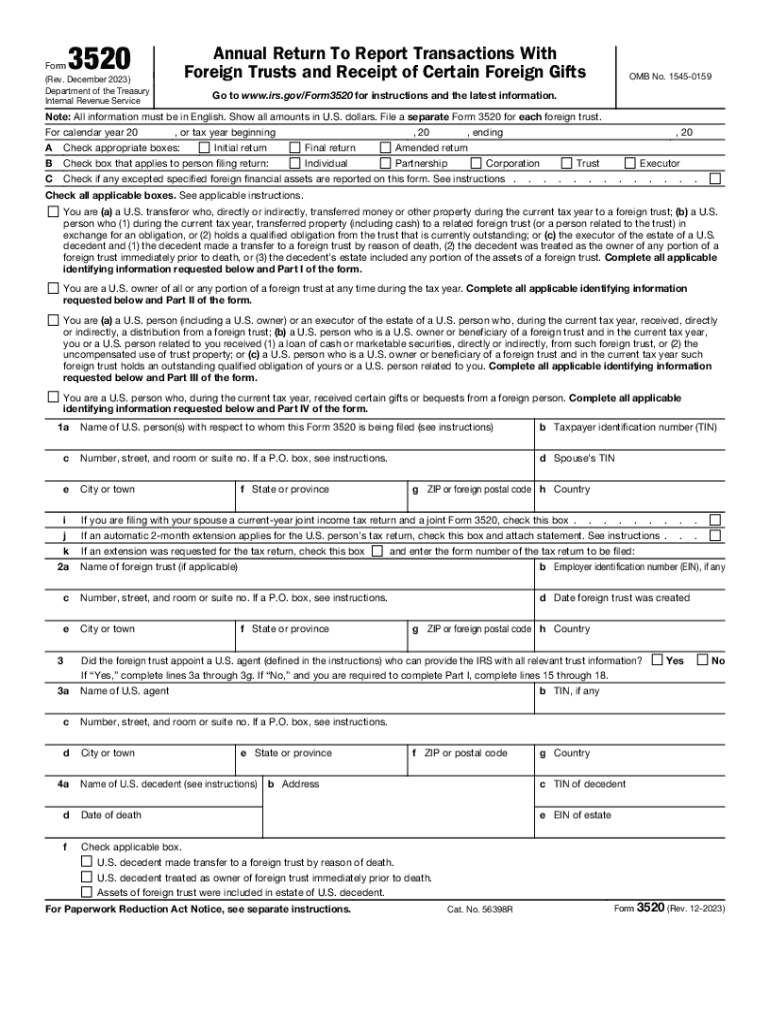

IRS 3520 2023-2026 free printable template

Instructions and Help about IRS 3520

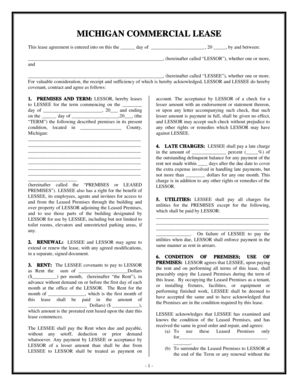

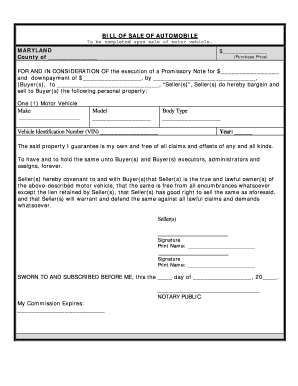

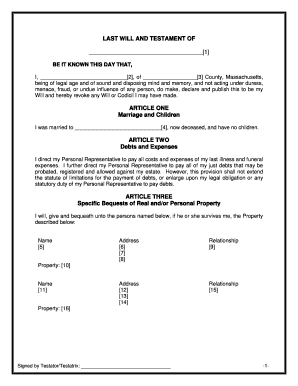

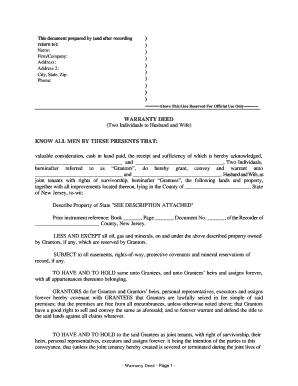

How to edit IRS 3520

How to fill out IRS 3520

Latest updates to IRS 3520

All You Need to Know About IRS 3520

What is IRS 3520?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 3520

What should I do if I realize I've made a mistake on my IRS 3520 form after filing?

If you discover an error on your submitted IRS 3520, you should file an amended return as soon as possible. Use the same form to indicate corrections and include an explanation of the changes. This helps avoid potential penalties for incorrect information.

How can I verify if my IRS 3520 has been received and is being processed?

To track the status of your IRS 3520, you can check the IRS's online tools or contact their customer service. If e-filed, you might receive confirmation via email; for paper submissions, it’s advisable to wait a few weeks before checking.

Are e-signatures acceptable for submitting the IRS 3520 electronically?

Yes, e-signatures are permitted for the IRS 3520 when e-filing, provided that the software used meets IRS specifications. Always ensure you follow the e-filing guidelines set by the IRS to maintain compliance.

What are some common errors filers make with the IRS 3520, and how can I avoid them?

Common mistakes include incorrect taxpayer identification numbers, failing to report all foreign accounts, and not adhering to the form's specific requirements. Carefully reviewing the instructions beforehand can help minimize these errors.

What should I do if I receive an IRS notice or letter regarding my IRS 3520 filing?

If you receive a notice concerning your IRS 3520, review it carefully for specific instructions. Prepare any necessary documentation requested and respond within the stated timeframe to avoid further complications or penalties.

See what our users say