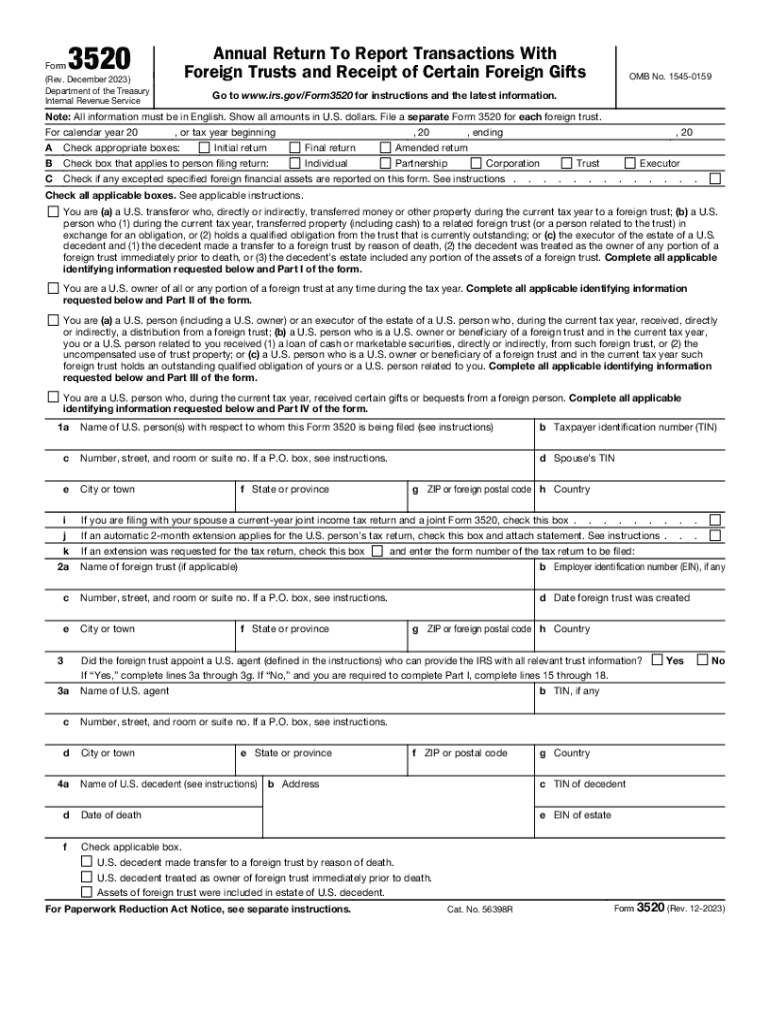

Who Needs IRS Form 3520?

Every U.S. citizen who owns a foreign trust or received a gift from a foreigner should file Form 3520. This document is also required for:

- Trust owners

- Trust distribution recipients

- Person who received a gift from foreigners

- Gift recipients from foreign corporations

What is IRS Form 3520 for?

Form 3520 is used to report transactions with foreign trusts and gifts that a US person has received from foreigners or foreign corporations during the current tax year. An important fact is that each foreign transaction with a trust should be reported on a separate Form 3520.

Is IRS Form 3520 Accompanied by other Forms?

Form 3520 isn’t accompanied by other documents. But it has a number of obligatory attachments. The full list of attachments can be found on the IRS website. There is also an opportunity for two transferors of the same trust to file a joint Form 3520.

When is IRS Form 3520 Due?

Form 3520 is filed simultaneously with an individual income tax return. If the form is filed on behalf of a decedent then its due date is the same as the due date of Form 706. All the time extensions are included in the deadlines.

How do I Fill out IRS Form 3520?

Form 3520 is a six-page document that comprises five parts and some schedules. The minimum amount of information that has to be provided in the form is:

- The filer’s identification information, address, Identification number

- Transfers to foreign trusts

- Distributions from a foreign trust

- Owner of the foreign trust

- Etc.

Every part contains some fields. There is an explanation for each field.

Where do I Send IRS Form 3520?

Once the form is completed, it is sent to the IRS.